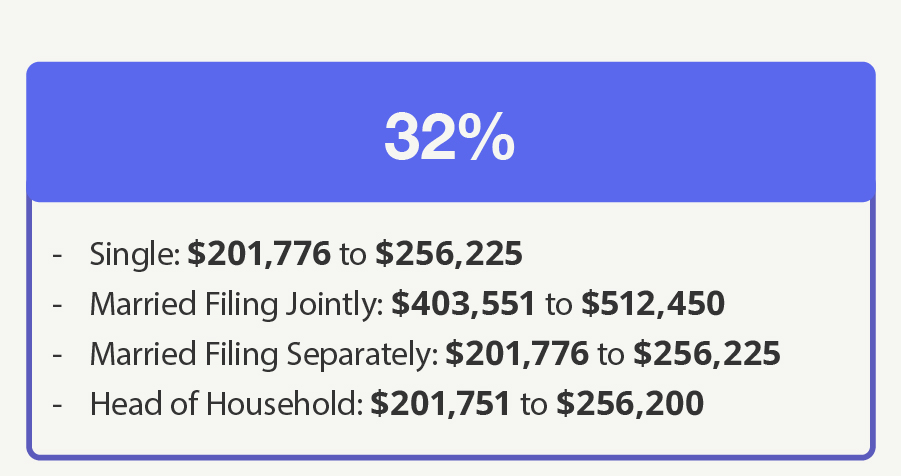

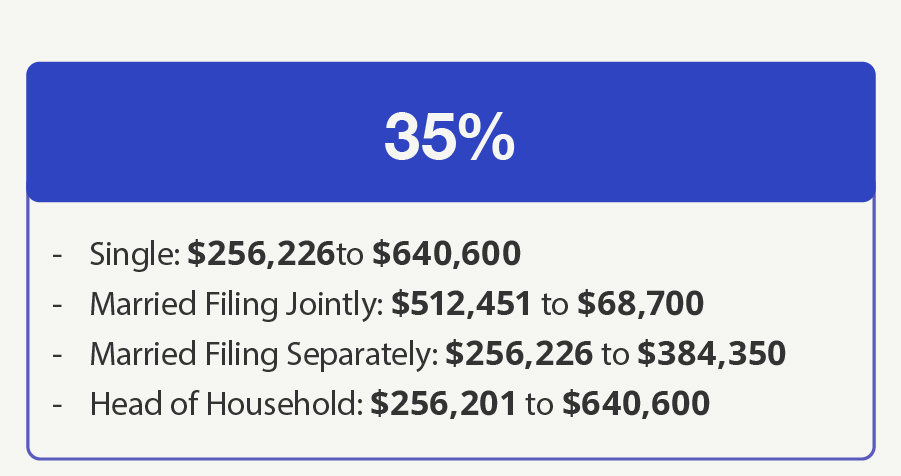

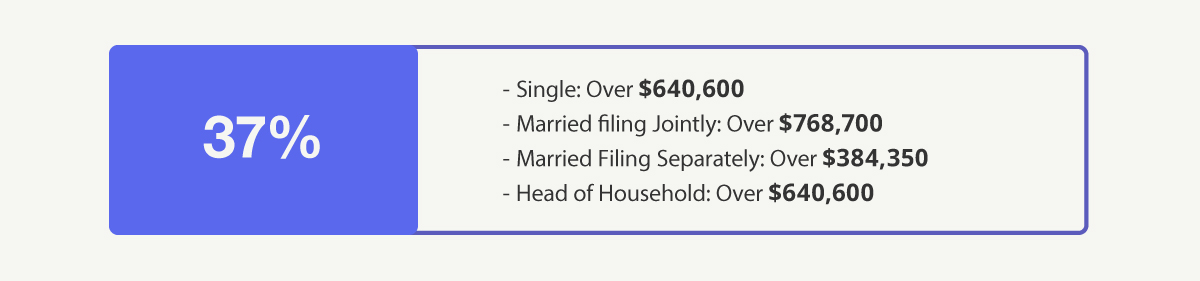

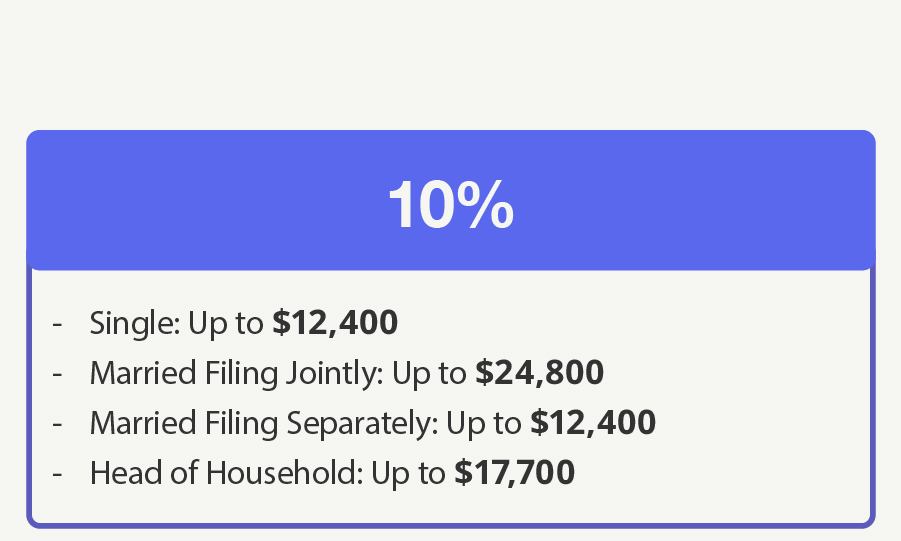

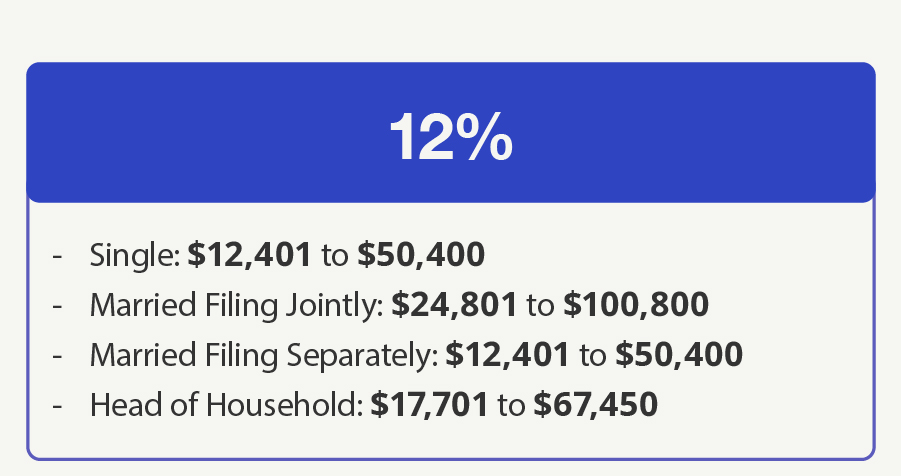

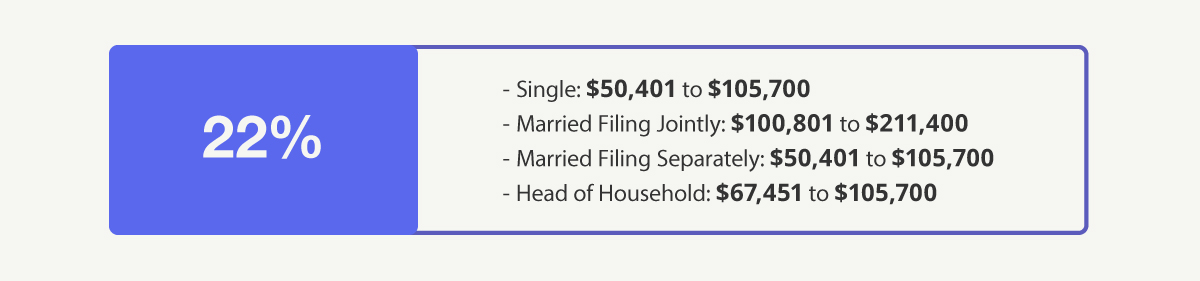

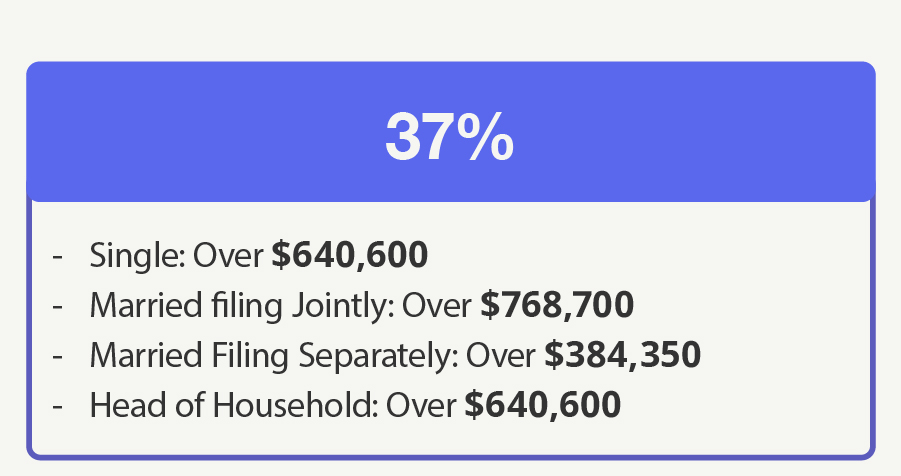

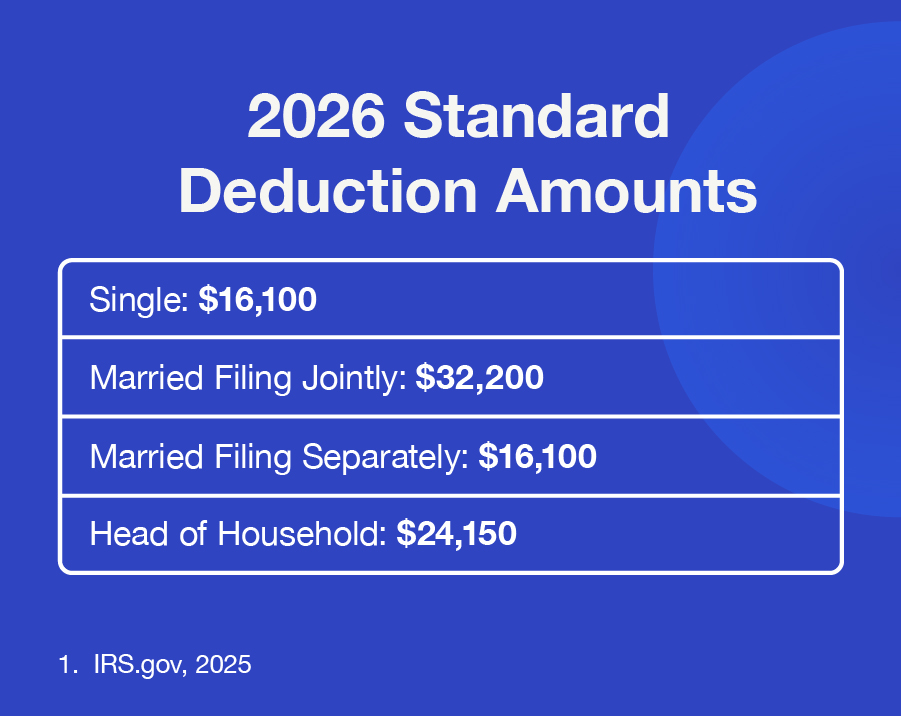

What's My 2026 Tax Bracket?

If you want to avoid potential surprises at tax time, it may make sense to know where you stand when it comes to the AMT.

A windfall from a loved one can be both rewarding and complicated.

Individuals have four basic choices with the 401(k) account they accrued at a previous employer.